I bought an apartment in Mewah Court in June last year, when the BLR was at 6.75%. Details as follows:

Price: RM145,000

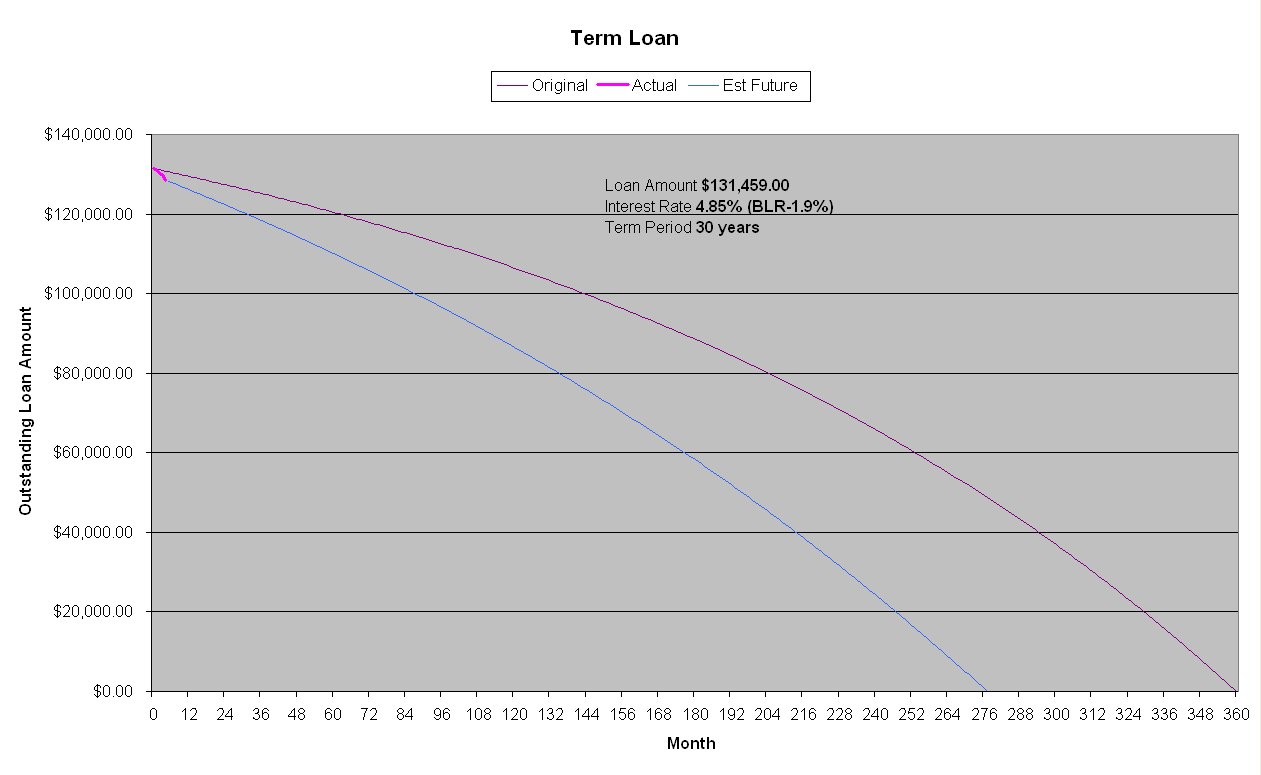

Loan financing: RM130,500 (up to 90%) for 30 years from RHB Bank

MRTA: RM959

Interest rate: BLR - 1.90% (equivalent to 4.85% that time)

Monthly repayment: RM694

Although having two separate lawyer firms handing my Sale & Purchase Agreement and Loan Agreement (which I would advise against, for it caused me much delay, inconvenience, and of course double-charged legal fees), I am quite happy with the home loan plan. I was actually looking forward to top up at least RM1,000 every month for partial payment to speed up the reduction of the outstanding loan every month, so that I could shorten my term by a few years.

And, as we all know, it happen that the time for my first loan repayment (November 2008) coincide with the dawn of the coming great recession. Still, RM694 does not cost much damage since I have no dependents :-)

On the other hand, the recession caused the BLR to gradually plunge in the following manner:

November 7, 2008: 6.75%

December 1, 2008: 6.50%

February 5, 2009: 5.95%

March 3, 2009: 5.55%

Now, my effective interest rate is 3.65% p.a.! With the reduced BLR and fixed monthly repayment, Bank Negara Malaysia has helped me reduce my term to 23 years! Yahoo!!

I could only wish either the BLR is maintained at its current level for a longer time, or the BLR is reduced some more. :-)

For information:

Latest Malaysia BLR

History of Malaysia BLR (1989 - Jan 2009)

No comments:

Post a Comment